How to Wield Strategic Technical Debt as an Advantage

Introduction

In the high-stakes world of startups, speed is currency. The pressure to ship features, capture market share, and out-innovate competitors is relentless. In this race, the term ‘technical debt’ is often whispered in hushed tones, a specter of impending doom that promises to bring even the most promising ventures to a grinding halt. It’s seen as a sign of sloppy engineering, a failure of process, a cancer that grows in the codebase. But what if this perception is fundamentally wrong? What if technical debt, when managed correctly, isn't a liability but one of the most powerful strategic assets in a startup CTO’s arsenal?

This is not a guide about avoiding technical debt. This is the startup CTO playbook for mastering it. It’s about understanding that in the chaotic, resource-constrained reality of a startup, perfection is the enemy of progress. The goal isn't to write flawless, infinitely scalable code from day one; it's to survive long enough to have the luxury of fixing the imperfect code you wrote to get there. This article reframes the conversation managing technical debt problem to a core component of business strategy. Here, you will learn how to wield debt deliberately, turning it into a calculated tool that buys you the most valuable commodity of all: time.

We will explore the crucial difference between the ‘good’ debt that fuels growth and the ‘bad’ debt that sinks companies. You'll learn how to make calculated decisions on when to borrow against your codebase to hit a critical product launch and, just as importantly, when to repay that debt before the interest compounds into a crisis. We'll move beyond abstract concepts to provide concrete frameworks for quantifying the invisible, using technical debt metrics and tools to make data-driven refactoring decisions. Finally, we'll discuss how to cultivate a team culture where engineers are empowered to use strategic technical debt as an advantage, fostering a sense of ownership and shared responsibility for the long-term health of the codebase.

By the end of this playbook, you will no longer fear technical debt. You will see it for what it truly is: a leveraged financial instrument for technology. You will learn to borrow with intention, repay with discipline, and ultimately use it to build a more resilient, competitive, and successful company.

The Two Faces of Technical Debt: From Hidden Danger to Strategic Weapon

To wield technical debt effectively, a CTO must first become a master assessor, distinguishing between the debt that propels a startup forward and the debt that drags it into obsolescence. This is the core of leveraging strategic technical debt. The distinction isn't merely academic; it’s the fundamental difference between a calculated risk and a reckless gamble. The legendary programmer Ward Cunningham, who coined the term, originally used the metaphor to explain how taking shortcuts on initial development is like borrowing money—it can get you where you need to go faster, but you'll have to pay interest on it later. Building on this, thought leader Martin Fowler introduced the Technical Debt Quadrant, a powerful framework for categorizing debt based on two key axes: intent (deliberate or inadvertent) and prudence (prudent or reckless).

Understanding this quadrant is the first step in building your startup CTO playbook for good vs bad technical debt.

- Reckless and Inadvertent ("The 'Whoops' Debt"): This is the most dangerous and least strategic form of debt. It's the "unknown unknowns" that crop up from a junior team’s lack of experience or a failure to understand a complex new technology. It’s unintentional, sloppy, and offers no strategic benefit. It’s pure downside, a landmine waiting to be stepped on during a future sprint.

- Reckless and Deliberate ("The 'Just Ship It' Debt"): This is the classic startup sin: knowing that a proper design is needed but consciously choosing to ignore it with no plan to fix it. "We don't have time for quality" is the mantra here. While it might feel necessary in a moment of crisis, this type of debt is taken on with a blatant disregard for the high-interest consequences, often leading to crippling refactoring projects down the line.

- Prudent and Inadvertent ("The Hindsight Debt"): This is a more forgivable form of debt. It arises when a team makes the best possible design decisions with the information they have, only to realize months later that the problem was more complex than initially understood. For example, building a single-tenant architecture that needs to be re-platformed for enterprise clients. This is the cost of learning, and while it must be managed, it’s a natural byproduct of innovation.

- Prudent and Deliberate (Strategic Technical Debt): This is the weapon. This is good vs bad technical debt in its clearest form. The team knows the clean, correct way to implement a feature but makes a conscious, calculated decision to take a shortcut for a specific, strategic reason. The key here is that the decision is *explicit*. The team acknowledges the trade-off, understands the "interest payments" (e.g., slower development in that module later), and has a rough plan for when to repay the "principal." An example is hardcoding a feature for a key design partner to close a crucial early deal, with a PBI already in the backlog to generalize the solution next quarter. This is how to use technical debt as an advantage.

The CTO’s job is to eliminate the reckless debt, mitigate the inadvertent debt, and strategically leverage the prudent, deliberate debt.

A Guide to Communicating Technical Debt to Non-Technical Stakeholders

One of the most critical skills in managing technical debt is translating its impact into business terms. Your CEO, CRO, and investors don't speak in terms of cyclomatic complexity; they speak in terms of revenue, risk, and velocity. This guide to communicating technical debt to non-technical stakeholders is essential. Framing the conversation correctly is key for getting buy-in to "repayment" cycles (i.e., refactoring sprints).

Instead of saying, "We need to refactor the billing module because the code is a mess," try using business-centric analogies. A powerful strategy is to connect the debt directly to their goals. For example:

- The "Leaky Bucket" Analogy: "Our current sign-up flow has some debt. Think of it like a leaky bucket. We're spending marketing dollars to pour leads in the top, but the bugs and slowness caused by the debt mean we're losing 15% of them before they can convert. Fixing the leaks will directly improve our customer acquisition cost."

- The "Potholed Road" Analogy: "Remember how long it took to add the new payment provider? That’s because the road to our payment system is full of potholes from past shortcuts. Every new feature we build on it requires navigating these potholes, making it slow and risky. We need a sprint to resurface the road so we can move faster and more safely in the future."

By shifting the dialogue from a technical vocabulary to a financial and risk-based one, you transform the perception of refactoring. As noted in a whitepaper by Construx on managing technical debt, this financial framework resonates immediately with executives. It’s no longer a cost center for "cleaning up code"; it's an investment in future feature velocity and a direct reduction of business risk.

The Art of the Deal: When to 'Borrow' and When to 'Repay'

If strategic technical debt is a financial instrument, then timing the market is everything. A loan that saves a company at the Seed stage could bankrupt it at Series C. A startup CTO's genius lies not in avoiding debt, but in knowing precisely when to take it on and having the discipline to pay it down before the interest grows malignant. This requires treating the startup lifecycle as a series of distinct phases, each with its own risk tolerance and strategic priorities. Funding rounds serve as natural inflection points for re-evaluating your technical balance sheet.

When to 'Borrow': Key Inflection Points for Taking on Debt

Taking on prudent, deliberate debt is an offensive maneuver. It's about trading future complexity for immediate market advantage. The best times to make this trade-off are when the potential rewards massively outweigh the calculated risks.

- The Pre-Seed/Seed Stage (The "Survival" Phase):

- Goal: Achieve Product-Market Fit (PMF).

- Debt Rationale: At this stage, your company's biggest existential threat isn't a messy codebase; it's building something nobody wants. As Wing VC advises early-stage startups, the issue of tech debt isn't truly important until you find PMF. This is the time to borrow aggressively to iterate quickly. Hardcode values for a demo, build a feature for a single pilot customer, or use a non-scalable third-party service to test a hypothesis. The goal is to learn as fast as possible. If the product pivots, the debt becomes irrelevant. If it succeeds, you've earned the right to fix it later.

- Example: A fintech startup manually processes a certain transaction type for its first ten customers to validate demand before spending three months building an automated, scalable solution.

- Closing a Marquee Customer or Strategic Partner:

- Goal: Secure a logo that validates your company and unlocks a new market segment.

- Debt Rationale: Winning a flagship customer can fundamentally change your startup's trajectory. If they require a specific feature or integration that you can deliver in two weeks with a shortcut, versus two months with a "proper" architecture, you take the shortcut. The strategic value of the partnership justifies the short-term debt.

- Example: An enterprise SaaS company builds a quick, bespoke integration for a Fortune 500 client, knowing it will need to be rebuilt as a generic integration framework post-launch.

- Beating a Competitor to a Key Market Window:

- Goal: Capture first-mover advantage for a critical feature set.

- Debt Rationale: In a competitive landscape, timing is a weapon. If you know a competitor is six months away from launching a game-changing feature, and you can ship a "V1" version in one month by taking on debt, you seize the opportunity. This allows you to capture the narrative, gather user feedback, and iterate while they are still in development.

- Example: A B2C app rushes a simplified version of a feature to market before a major industry conference, planning to refactor and expand it in the following quarter.

When to 'Repay': A Framework for Paying Down Debt

Repaying technical debt is a defensive maneuver. It’s about ensuring the foundation is strong enough to support the next phase of growth. The question of when to repay technical debt in a startup is critical. As one expert on Medium notes, raising a new round of funding is a prime opportunity to invest in paying down debt, as those investments will pay dividends as the team scales.

- Post Product-Market Fit & Pre-Series A (The "Foundation" Phase):

- Trigger: You're no longer searching for a business model; you have one, and it's showing signs of traction. Your core user loops are stabilizing.

- Repayment Plan: Allocate a dedicated percentage of each sprint (e.g., 20% of story points) to paying down the most painful debt from the "survival" phase. Focus on areas that cause the most developer friction or customer-facing bugs. The goal is to harden the core product so it can handle the first wave of real growth without constant firefighting.

- Post-Series A Funding (The "Scaling" Phase):

- Trigger: You've just raised a significant round of capital and are expected to 10x your user base and engineering team.

- Repayment Plan: This is the most critical repayment window. The shortcuts that worked for 1,000 users will catastrophically fail at 100,000. The codebase that a 5-person team could navigate will cripple a 30-person team. Use the new capital to justify a "stabilization and scale" initiative. This might involve one or more full sprints dedicated to major refactoring, replatforming a core service, or improving CI/CD pipelines. This isn't about gold-plating; it's about ensuring your new engineering hires can be productive from day one and that the system can handle the coming load.

- When Onboarding New Engineers Becomes Painful:

- Trigger: Your metric for "time to first commit" for new hires is steadily increasing. Senior engineers are spending more time explaining convoluted workarounds than building new features.

- Repayment Plan: Treat developer productivity as a first-class metric. Frame debt repayment as an investment in efficiency. Run internal surveys to identify the top 3 areas of the codebase that slow developers down. Create a dedicated task force or "platform team" to address these specific pain points, with the explicit goal of improving the developer experience and accelerating future development.

The key is to integrate debt repayment into the natural rhythm of the business. As ProductPlan suggests, these tasks must live on the main backlog where they can be tracked and prioritized against feature work, not on a hidden list that is perpetually ignored. By aligning borrowing and repayment cycles with your startup's strategic inflection points, you transform debt from a reactive problem into a proactive, powerful tool for growth.

Quantifying the Invisible: Metrics and Tools for Managing Technical Debt

"What gets measured gets managed." For a startup CTO, this adage is the key to elevating the technical debt conversation from subjective complaints to a data-driven strategic discussion. To stop guessing and start measuring, you must arm your team with a combination of objective code quality metrics and powerful analysis tools. This allows you to quantify the "interest payments" on your debt, identify hotspots in the codebase, and justify refactoring initiatives with cold, hard data, which is central to any strategic technical debt plan.

Key Technical Debt Metrics That Matter

While there are dozens of potential metrics, a handful provide the most signal for a fast-moving startup. Focus on these leading indicators of future problems.

- Cyclomatic Complexity:

- What it is: At its core, Cyclomatic Complexity is a measure of how many independent paths there are through a piece of code. A function with a high cyclomatic complexity score has many `if`, `for`, and `while` statements, creating a tangled web of logic.

- Why it matters: As SonarQube's documentation explains, a higher complexity score means the code is harder to understand, harder to test, and more likely to contain bugs. A high score isn't just an abstract number; it's a direct indicator of risk and a tax on any developer who has to touch that code.

- Actionable Threshold: Aim to keep the complexity of individual methods below 10. When a function creeps above 15, it should be flagged for immediate refactoring.

- Code Churn (or High-Frequency Change):

- What it is: Code churn measures how often a file or module is changed. As defined by Stepsize, it’s the number of times lines of code have been deleted, replaced, or rewritten.

- Why it matters: High churn in a specific area of the codebase is a strong signal that the existing design is failing. Developers are constantly fighting with the code, indicating unclear requirements, brittle logic, or a poor abstraction. It's a hotspot of "interest payments."

- The Power Combo: The real magic happens when you combine metrics. A module with high Cyclomatic Complexity AND high Code Churn is a five-alarm fire. This is a complex, brittle part of your system that developers are constantly struggling with. As Red Star IT points out, this combination dramatically increases the likelihood of new bugs being introduced with every change. This is the #1 candidate for your next refactoring sprint.

- Code Coverage:

- What it is: The percentage of your codebase that is covered by automated tests.

- Why it matters: In the context of technical debt, code coverage is your safety net. Taking on strategic debt by shipping a feature with a "good enough" design is a reasonable bet. Shipping it with zero tests is reckless. Low code coverage in a module means any future changes—whether adding a feature or refactoring debt—are fraught with peril, dramatically increasing the cost and risk of that work.

- Actionable Threshold: While 100% is unrealistic for a startup, a healthy baseline is 80% for critical business logic. If a core module drops below 60%, paying down debt in that area becomes a high-risk activity and should be preceded by a "testing sprint."

Essential Tools for Measuring Technical Debt

Manual analysis is impossible at scale. Leveraging automated tools is essential for creating a sustainable system for managing technical debt. These tools integrate into your CI/CD pipeline, providing continuous feedback and preventing new debt from creeping in unnoticed.

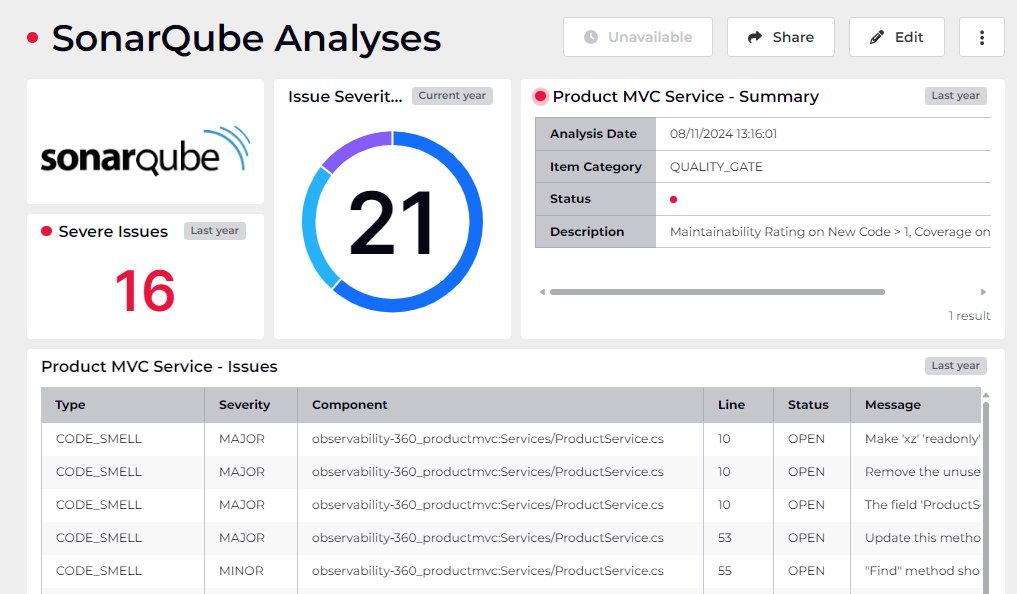

- SonarQube: An open-source platform that has become the industry standard for continuous code quality inspection. SonarQube is a powerhouse, providing detailed analysis on everything from code smells and security vulnerabilities to complexity and duplication. Its "Technical Debt Ratio" and "Maintainability Rating" are excellent high-level metrics for communicating the overall health of the codebase to non-technical stakeholders.

- CodeClimate: A popular SaaS solution that provides automated code review and quality analysis. CodeClimate excels at providing a simple, maintainability grade (A-F) for your files, making it easy to spot declining quality at a glance. It integrates directly into GitHub pull requests, providing immediate feedback to developers before bad code is merged, helping to enforce quality gates and prevent inadvertent debt.

- NDepend: For startups in the .NET ecosystem, NDepend is an incredibly powerful static analysis tool. It offers advanced features like dependency graph analysis and trend monitoring, allowing you to visualize your architecture and see how technical debt is evolving over time. It can answer complex questions like, "Which of my high-complexity methods are least covered by tests?" turning abstract concerns into a concrete, prioritized list of action items.

By implementing these metrics and tools, you shift the conversation from "we feel like the code is getting messy" to "our core payment module has a cyclomatic complexity of 22, a code churn rate 3x the average, and only 40% test coverage; it represents our single biggest business risk." That is a language that secures resources, aligns teams, and turns the invisible problem of technical debt into a tangible, manageable part of your strategic playbook.

Building a Culture of 'Debt-Awareness': Your Team's Role in Sustainable Growth

A startup CTO can define the playbook for strategic technical debt, but only the engineering team can execute it. Tools and metrics provide visibility, but culture dictates behavior. A sustainable approach to managing technical debt is not about top-down enforcement; it's about fostering a culture of collective ownership, psychological safety, and shared understanding. Without this foundation, the best-laid plans will crumble under the pressure of the next product deadline. Your role is to shift the team's mindset from viewing technical debt as a sign of individual failure to seeing it as a shared, technical balance sheet that everyone is responsible for maintaining.

Principle 1: Promote Collective Code Ownership

In a fast-growing startup, the idea of a single developer "owning" a service is a bottleneck waiting to happen. Instead, high-performing teams, as highlighted in the seminal book Accelerate, practice collective code ownership. This doesn't mean a free-for-all; it means the team, as a unit, is responsible for the quality of their domain's codebase.

- How it Works: Encourage pairing and swarming on complex tickets. Ensure pull requests are reviewed by multiple team members to spread knowledge. As DigitalOcean advocates, fostering collective ownership encourages collaboration and shared accountability. When the whole team feels responsible for the code, they are more likely to identify and address debt proactively, rather than pointing fingers at the original author.

- The "Boy Scout Rule": A cornerstone of this culture is the mantra: "Always leave the code better than you found it." This simple principle, when practiced consistently, turns every feature ticket into a small opportunity for debt repayment. Fixing a typo, renaming a confusing variable, or adding a missing test while working on a related task creates a virtuous cycle of continuous improvement.

Principle 2: Establish Psychological Safety

Psychological safety is the bedrock of a debt-aware culture. It's the belief that a team member won't be punished or humiliated for speaking up with ideas, questions, concerns, or mistakes. Without it, your engineers will hide their shortcuts, ignore growing problems, and avoid admitting they don't understand a piece of complex code—all of which are breeding grounds for reckless, inadvertent debt.

- Leading by Example: As a CTO, you must model this behavior. Talk openly about past technical decisions that turned out to be wrong. Celebrate the discovery of a critical bug as a learning opportunity, not a failure. When an engineer flags a piece of their own code as a candidate for refactoring, they should be praised for their foresight and ownership, not criticized for writing "bad" code.

- Blameless Post-Mortems: When an issue inevitably occurs due to accumulated debt, the focus of the review must be on the "what" and "how," not the "who." The goal is to understand the systemic pressures and process failures that led to the decision, not to assign blame. This builds trust and encourages engineers to be transparent about risks in the future.

Principle 3: Align on the 'Why' with Clear Team Structures

Engineers need to understand the business context behind the trade-offs they are asked to make. Taking on debt feels much more purposeful when the team knows it's to land a crucial Series A client, versus feeling like they are simply being forced to cut corners. This is where team structure and clear communication become paramount.

- Inspired by 'Team Topologies': The book Team Topologies provides a powerful model for organizing teams to manage cognitive load and improve flow. For managing technical debt, this means ensuring your "Stream-aligned" teams (the teams building product features) are empowered to make debt-related decisions within their domain. They have the most context on the trade-offs.

- Creating a 'Platform' Team: As you scale, consider creating a "Platform" team whose primary customer is your other engineering teams. Their mission is to reduce the cognitive load on stream-aligned teams by providing stable, easy-to-use tools, APIs, and infrastructure. This team becomes the natural owner for paying down systemic, cross-cutting debt, freeing up the product teams to manage their own local, strategic debt. This creates a healthy tension and balance, ensuring that someone is always focused on the long-term health of the foundation.

Atlassian summarizes it well: building a culture that values long-term code quality over short-term speed helps teams make better architectural decisions from the start. By investing in these cultural principles, you empower your team to not just execute the playbook, but to improve it, turning them into a proactive, debt-aware force that drives sustainable growth.

Conclusion: Your Action Plan for Mastering Technical Debt

We've journeyed through the dual nature of technical debt, reframing it from a hidden danger into a potent strategic weapon. You've learned how to distinguish good debt from bad, how to align borrowing and repayment with your startup's lifecycle, the tools to make the invisible visible, and the cultural tenets required for sustainable success. But insight without action is meaningless. It’s time to close the gap between theory and execution.

Mastering strategic technical debt isn't a one-time fix; it's an ongoing discipline. It requires a fundamental shift in how technology is discussed, prioritized, and valued within your organization. You are not just a CTO; you are the portfolio manager for the company's most critical asset: its codebase. Like any skilled financial manager, your job is to leverage debt to maximize returns while diligently managing risk, ensuring the asset grows in value over the long term. This playbook has given you the framework, and now you can walk away with a clear, 3-step action plan to implement these strategies immediately.

Your Immediate 3-Step Action Plan

- Step 1: Triage and Visualize Your Current Debt (The First 7 Days).

- Action: You can't manage what you can't see. Your first step is to create a comprehensive, high-level map of your existing technical debt.

- How:

- Run the Tools: Install and run a static analysis tool like SonarQube or CodeClimate on your primary repository. Get an immediate, objective baseline of your code's health.

- Survey the Team: Hold a "technical debt amnesty" session with your engineers. Create a safe space for them to anonymously (or openly) nominate the top 3 areas of the codebase that cause the most pain, slow them down, or feel the most fragile.

- Create the List: Consolidate these findings into a single, prioritized backlog. Don't boil the ocean. Identify the top 10 "debt hotspots" based on a combination of quantitative data (high complexity, high churn) and qualitative pain points (developer frustration). This list is your initial repayment roadmap.

- Step 2: Socialize the Framework and Secure Buy-In (The First 30 Days).

- Action: Translate your findings into the language of the business and align all stakeholders on the new playbook.

- How:

- Build the Business Case: Take one of your top debt hotspots (e.g., the slow, buggy checkout process) and create a mini-presentation. Don't talk about code; talk about the business impact. Use the analogies from Chapter 1. Show the estimated cost in terms of lost revenue, delayed feature launches, or developer attrition risk.

- Propose the "20% Rule": Introduce the concept of allocating a dedicated portion of each sprint—many successful teams start with 20%—to addressing items from your new technical debt backlog. Frame this not as a "tax" on innovation but as an "investment" in future velocity. As recommended by CTO Magazine, this consistent allocation keeps the codebase clean without sacrificing roadmap velocity.

- Get it on the Roadmap: Work with your product counterpart to get this 20% allocation officially recognized in your quarterly planning and roadmap documents.

- Step 3: Operationalize and Celebrate (The First 90 Days).

- Action: Embed the practice of managing technical debt into your team's daily, weekly, and monthly rituals.

- How:

- Integrate into Sprints: Make "Debt Repayment" a formal part of sprint planning. The team should pull prioritized debt stories from the backlog just as they would feature stories.

- Automate Quality Gates: Configure your CI/CD pipeline with your new tools to fail any pull request that introduces a critical code quality issue or drops test coverage below a set threshold. This stops the bleeding and prevents new, inadvertent debt.

- Celebrate the Wins: When a team successfully refactors a painful module, celebrate it. Showcase the "before and after" metrics in your next all-hands or engineering demo. Highlight how the new, cleaner code allowed the next feature to be built in half the time. This creates a powerful feedback loop, reinforcing the value of the new culture and proving that mastering technical debt is the ultimate competitive advantage.

By following this action plan, you will transform your company's relationship with technical debt, moving it from a source of chronic stress to a powerful, intentional tool for building a resilient, scalable, and enduring business.

Related Articles

Technical Debt Management: A Startup CTO's Playbook for 2026

Introduction Technical debt, the silent killer of startup agility, is more than just messy code. It's the implied cost of rework caused by choosing an easy solution now instead of a better approach that would take longer. For a startup CTO, ignoring it is like borrowing from a lender with compounding interest that can cripple your growth. A McKinsey & Company report warns that technical debt can swallow up to 40% of a company's technology estate value, a staggering figure that directly translat

Read More

System Design Interview: The Ultimate Guide to Acing Your FAANG Interview in 2025

Demystifying the System Design Interview: What to Expect in a FAANG Interview Before diving into complex architectural patterns, it's crucial to understand the fundamentals of the system design interview (SDI). This chapter lays the groundwork, defining what these interviews entail at FAANG and other top-tier tech companies, their unique challenges, and the key evaluation criteria used to assess candidates in 2025. A system design interview is a high-level technical discussion where you're ask

Read More

The "Fixed Price" Mirage: Why You’re Buying Technical Debt, Not Certainty

Your CFO loves fixed-price contracts. They fit perfectly into a Q3 budget spreadsheet. You know exactly what you are spending. You have a signed piece of paper promising a specific set of features on a specific date. It feels safe. It is actually the riskiest way to build software. In agile development, a fixed-price bid is a lie agreed upon by both parties. You pretend requirements won't change. The vendor pretends they know exactly how long complex engineering tasks will take. When reality

Read More